Words by Funmi Oduniyi

What the hell is Bitcoin, anyway? We break down everything you need to know about the world’s favourite cryptocurrency.

In a time when the coronavirus pandemic has caused central banks to essentially create and print vast sums of money, many have called for the move away from paper-based currencies to a fully-digitalised currency system in the form of Bitcoin. Bitcoin has always been in and around the news in recent years, but its consideration as a legitimate alternative to paper currency has always been justifiably questioned. Much of this scepticism is due to the lack of information and understanding of it, but also given its relative infancy as a form of currency. So, what is Bitcoin? What are the benefits and drawbacks of Bitcoin? And most importantly, will it ever become the dominant form of currency?

What is Bitcoin?

Bitcoin is a cryptocurrency created in 2008 by an unknown person or group of people under the name Satoshi Nakotomo. A cryptocurrency is essentially a digital asset designed to work as a medium of exchange (like cash), wherein individual coin ownership records are stored in a digital ledger or computerised database – using strong encryption to secure transaction record entries and verify the transfer of coin ownership. So how does it work as a currency? Well, users exchange money for Bitcoins at an online exchange, then use the Bitcoins to pay for secure online transactions which cannot be decrypted and traced. What makes Bitcoin special, though, is that it was the first decentralized digital currency, which essentially means that it’s not controlled by any central banks or government, unlike traditional cash currencies and other cryptocurrencies. Therefore, no central bank or government can control the number of Bitcoins in existence, nor can they monitor and trace the flow of Bitcoins.

The benefits of Bitcoin

One of the main reasons why Bitcoin has grown in popularity and status is its decentralised nature. This prevents governments and central banks controlling it, thus freeing users of national monetary policies. We have seen, over the last decade, the negative implications brought about by central banks controlling currencies and using monetary policies. The implementation of quantitative easing, specifically, has created much cause for concern given its unknown long-term effects and potential to create hyperinflation. Hyperinflation destabilises entire economies and can make money essentially worthless. We need only look at 1920s Germany and present-day Zimbabwe to see the consequences of governments excessively printing money – hyperinflation can destroy entire countries. So, with many central banks, such as the Fed, printing trillions of dollars in just a matter of weeks during the height of the coronavirus crisis in 2020, the long-term potential for hyperinflation increases. Thus, for residents of countries that have a destabilised currency, Bitcoin can serve as an alternative due to its immunity to inflation and deflation.

What’s more, a decentralised currency like Bitcoin insulates consumers from bank failures and collapses. We only have to look at the 2008 financial crisis to see how the failures of banks were felt by the ordinary person. Some banks filed for bankruptcy and many had to be bailed out, causing the knock-on effect of a liquidity crisis where many consumers had minimal or difficult access to their own money. A decentralised currency would prevent us from a repeat incident, as our money would no longer be held by banks but instead exist in our own digital wallet, preventing us from being negatively impacted by incompetent bank policies. Lastly, the introduction of Bitcoin would lead to significantly lower transaction costs and improved security of transactions for consumers. Currently, sending money abroad or just buying goods online requires payment processors who charge transaction fees and are susceptible to hacking. Bitcoin, however, uses cryptographic security that doesn’t require any payment processors, which therefore reduces transaction costs and prevents the potential for transaction hacking.

The drawbacks of Bitcoin

While there are significant benefits to Bitcoin, as explained above, the very things that make Bitcoin attractive are also the same things that hold back its progress. While the decentralised nature of Bitcoin helps in some regards, its biggest drawback is that this opens the opportunity for illegal activity to take place. As Bitcoin is unregulated and heavily encrypted, it is impossible to trace and identify the source or destinations of funds, opening the door for criminals to launder money without being caught.

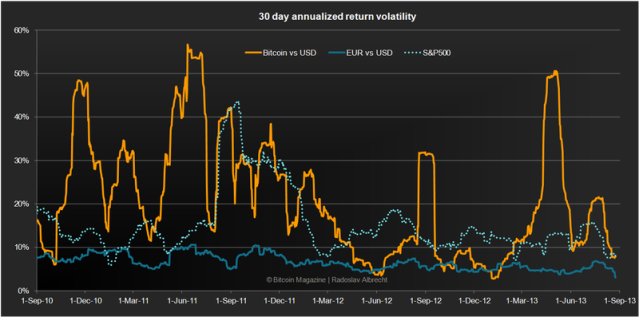

In addition, the highly volatile nature of Bitcoin stalls its progress as being a viable currency. Since market prices for cryptocurrencies are based on supply and demand, the rate at which a cryptocurrency can be exchanged for another currency can fluctuate widely, as the design of many cryptocurrencies ensures a high degree of scarcity. This is prominent a prominent issue with Bitcoin; it has experienced various rapid surges and collapses in value, climbing as high as $19,000 per Bitcoin in December 2017 before dropping to around $7,000 in the following months. It’s this highly volatile nature which leads many economists to believe Bitcoin is a short-lived fantasy or speculative bubble.

Lastly, the vulnerability of Bitcoin’s underlying structure also weakens its credibility as a currency. While the blockchains used to send money from one source to another are secure, the actual digital wallets which hold Bitcoins are susceptible to hacking. In Bitcoin’s 10-year history, several online wallets have been the subject of hacking and theft, sometimes with millions of dollars’ worth of “coins” stolen. A major example was the hacking of Mt. Gox, the largest Bitcoin exchange in 2014, where nearly $473 million of customers’ Bitcoin was stolen.

So, where are we now?

Bitcoin’s future as a currency is still murky, with its most pressing security issues yet to be totally resolved. For now, though, the continued incompetence and poor monetary policy decision-making by central banks and governments around the world add more leverage and credibility to digital currencies like Bitcoin by the day. Bitcoin’s digital payment protocol setup has also laid the important foundation for this currency to grow and develop into a viable medium of exchange. In 2021, we have to settle with a hybrid economy that uses both digital and fiat (paper) currencies. The increasing use of contactless payments like Apple Pay in today’s society, though, nonetheless proves that we’re on the path towards a totally-cashless currency in the near future – with Bitcoin leading the way.

This article was originally published by FO’s Perspectives.